mobile al sales tax rate 2019

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. It plans to introduce a Value Added Tax VAT by the end of 2018.

A Small Business Guide To E Commerce Sales Tax The Blueprint

On December 9 2019.

. The rate of sale tax you paid must be the same as the general sales tax rate otherwise you can only deduct the general sales tax rate. To deduct vehicle sales tax you can either. The rate type is noted as Restaurant in MAT.

Data are in 2017 dollars 2020 est 7395 billion note. This means youre responsible for applying the sales tax rate determined by the ship-to address on all taxable sales. 10312019 October USF Appeals Disposition Public Notice.

These tables calculate the estimated sales tax you paid based on your. Self-Employed defined as a return with a Schedule CC-EZ tax form. In a 2017 study Alstadsæter et al.

Data are in 2017 dollars 2018 est note. Save all sales receipts and deduct actual sales taxes paid throughout the year or. Consistent with precedent WCB grants dismisses or denies a number of.

Data are in 2010 dollars. Concluded based on random stratified audits and leaked data that occurrence of tax evasion rises sharply as amount of wealth rises and that the very richest are about 10 times more likely than average people to engage in tax evasion. Academy of Detroit West Redford Michigan et al Order.

For more information see the Alabama Department of. 1 online tax filing solution for self-employed. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

However eligible sellers may participate in Alabamas Simplified Sellers Use Tax SSUT program which enables them to collect report and remit a flat 8 percent sellers use tax on all sales made into Alabama. Real GDP purchasing power parity 6965 billion note. Use the IRS sales tax tables to figure your deduction.

Americas 1 tax preparation provider. The Food Service Establishment Tax is a five percent 5 sales tax levied in lieu of the five 5 general sales tax on the gross proceeds of sales at retail of food andor beverages sold for consumption. Real GDP growth rate.

1172019 Mobile Stage 2 Election Deadline Public Notice. Country comparison to the world. Data are in 2017 dollars 2019 est 7251 billion note.

The deadline for the election of Stage 2 mobile support is 600 pm. The tax gap describes how much tax should have been raised in relation to much tax is actually raised.

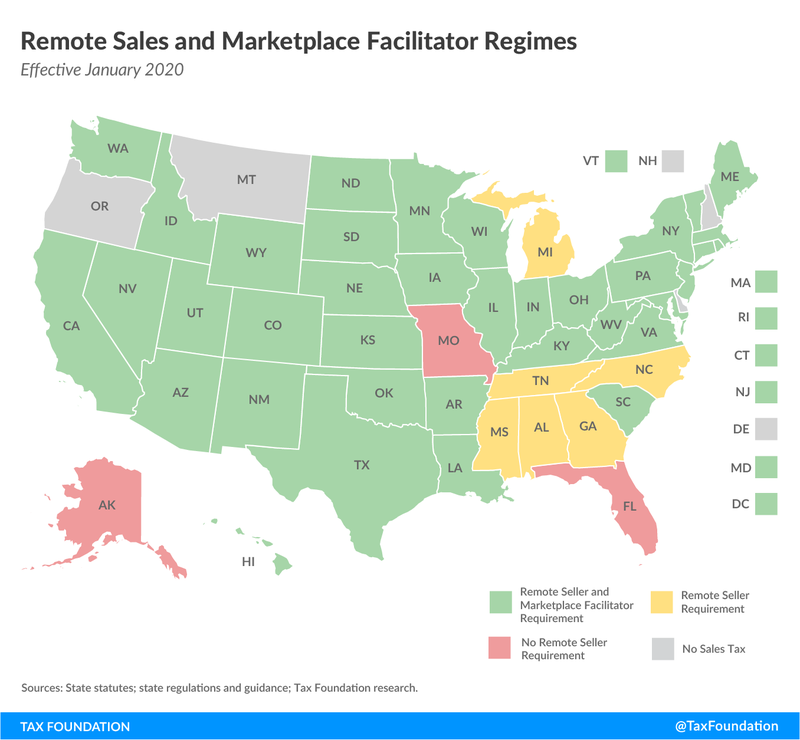

States Without Sales Tax Article

Sales And Use Tax Rates Houston Org

States With Highest And Lowest Sales Tax Rates

How Is Tax Liability Calculated Common Tax Questions Answered

Alabama Sales Use Tax Guide Avalara

Alabama Sales Tax Rates By City County 2022

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax On Grocery Items Taxjar

How Do State And Local Sales Taxes Work Tax Policy Center

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

6 Differences Between Vat And Us Sales Tax

Michigan Sales Tax Small Business Guide Truic

Ciberseguridad Exposicion De Libros De La Biblioteca De La Universidad De Zaragoza Sobre Delincuencia Informatica Derechos Digitales Proteccion De Datos Pers Periodic Table

Be A Part Of World Free Tax Zone Register Your Company Today Business Management Business Support Services Business

How Is Tax Liability Calculated Common Tax Questions Answered